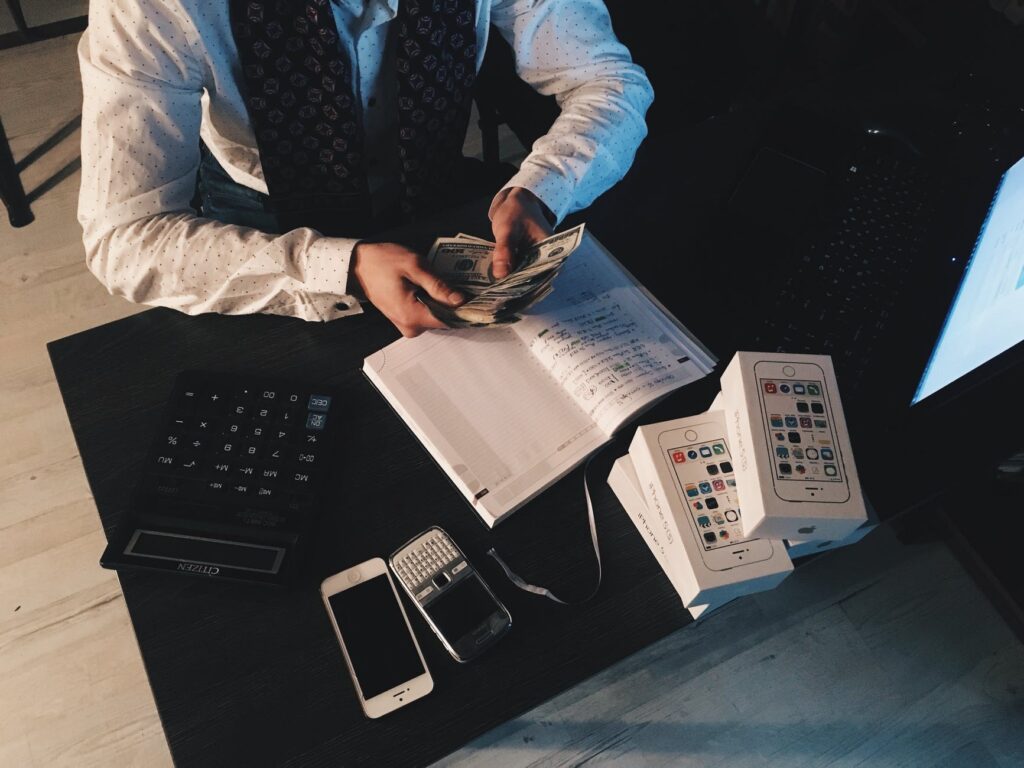

The main goal of a startup is to achieve quick success related to the launch of its new product. Research shows that the internet is the main area for startups to operate. This gives the opportunity to expand the territory of operation which is a great chance for financial success. However, one of the biggest challenges for startups is raising funding. Money is needed for expensive research, development of the right technology, and paying for the facilities of specialists, among other things. Read the article to the end and find out how startups are financed.

Equity capital

Some startups use equity (bootstrapping) – savings or money borrowed from immediate family members. However, this is often only possible during the startup’s initial development. With time and progress, innovative works require more and more resources, which requires raising external capital.

PARP (Polish Agency for Enterprise Development)

It is a state body tasked with supporting the development of small and medium-sized enterprises. It has at its disposal both state and EU capital, which it allocates for grants that can be used by startups and for organization of trainings.

How are startups financed? – Business Angels

This is an entrepreneur who has successfully created one or several successful businesses. They use their experience to support the development of a new company and gain their own benefits. Such individuals have the knowledge, resources and connections in the business world and are therefore able to significantly influence the development of a startup in exchange for shares.

Venture Capital

Venture Capital is a type of investment undertaken by funds prepared especially for such activities. Their goal is to acquire shares of a startup and later sell them (with a high profit). In order to achieve it, Venture Capital funds subsidize promising companies that already operate on the market but are at an early stage of development. Everything is done in exchange for shares or stocks (if they are on the stock exchange). The involvement of VC funds usually lasts from three to seven years, after which they sell the shares acquired at the beginning of cooperation with a startup, thus gaining profit (or recording a loss).